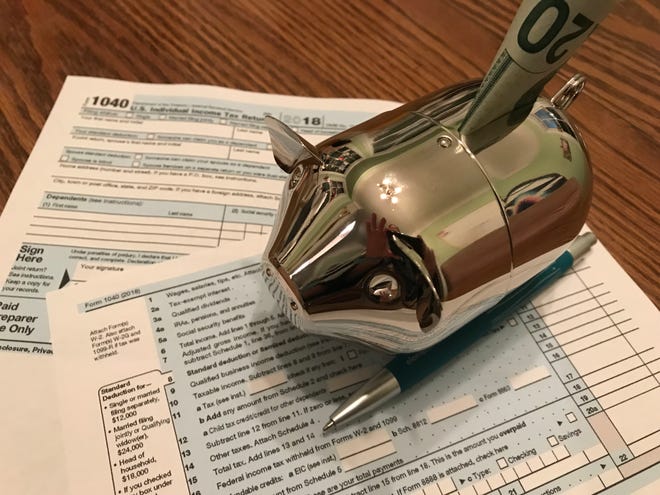

Are the instructions for calculating the taxable portion of the state tax refund correct? Referencing non-existent lines on 2018 1040 (line 40, 44, 56, etc)?

IRS tax refund tips to get more money back with write-offs for unemployment, loans and more - ABC7 Chicago

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)