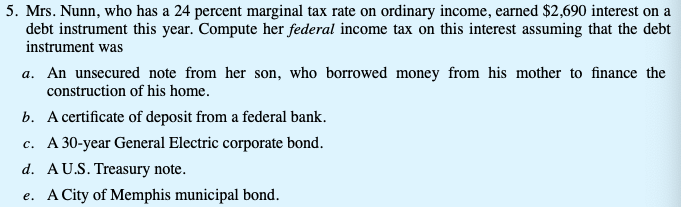

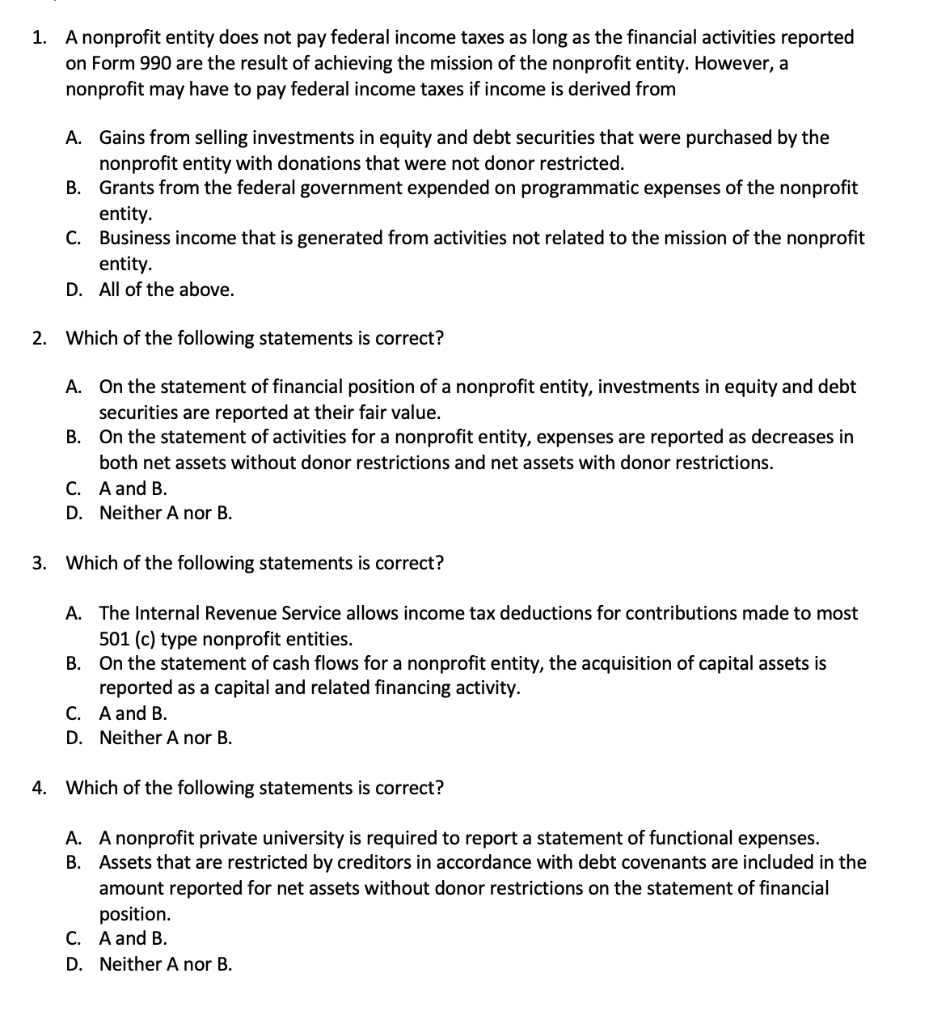

Federal Income Taxation of Debt Instruments - 7th Edition: David C. Garlock, J.D., Principal Author and Editor., Contributing Authors: Matthew S. Blum, Contributing Authors: Dr. Kyle H. Klein, Contributing Authors: Richard G.

Federal Income Taxation of Debt Instruments (2021): David C. Garlock: 9780808055228: Amazon.com: Books

Federal Income Taxation of Debt Instruments - David C. Garlock, Reuven Shlomo Avi-Yonah - Google Books

/AgencyBonds_LimitedRiskAndHigherReturn32-9a575588ab6b4e4484cc80d0a8f9710c.png)

/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)