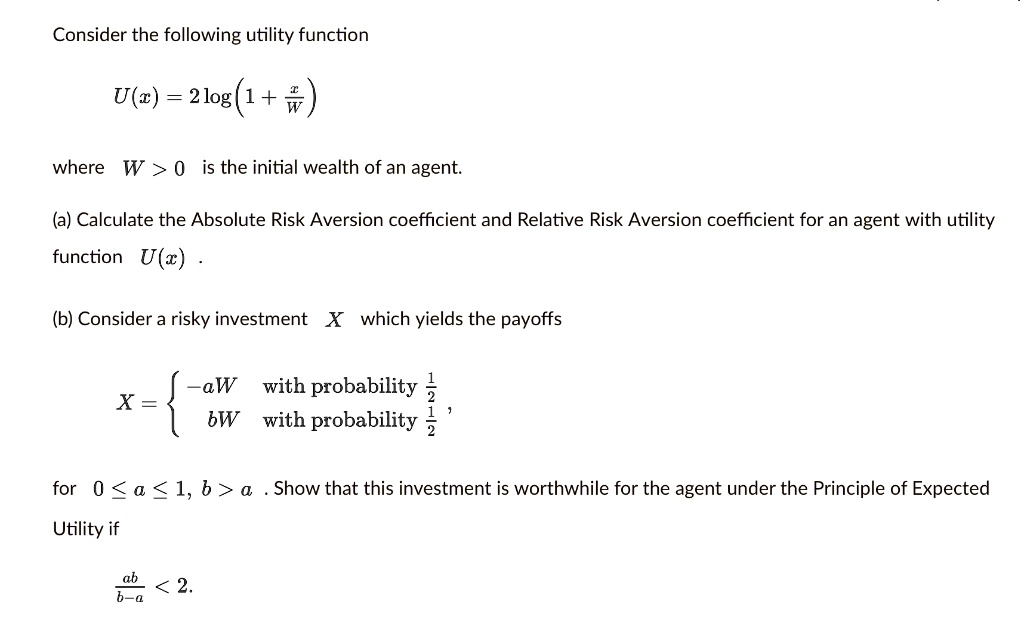

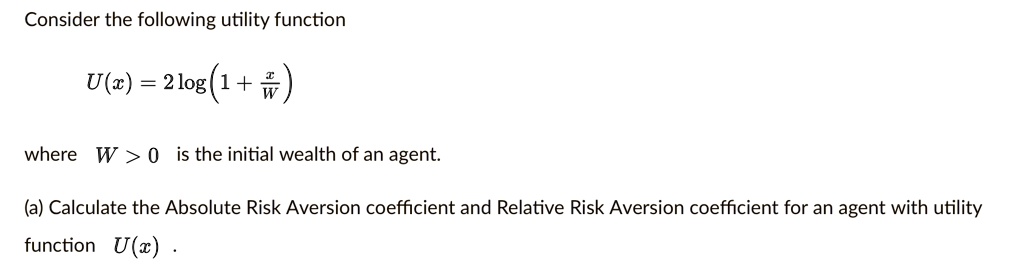

SOLVED: Consider the following utility function U(c) = 2log(1+ w ) where W > 0 is the initial wealth of an agent: (a) Calculate the Absolute Risk Aversion coefficient and Relative Risk

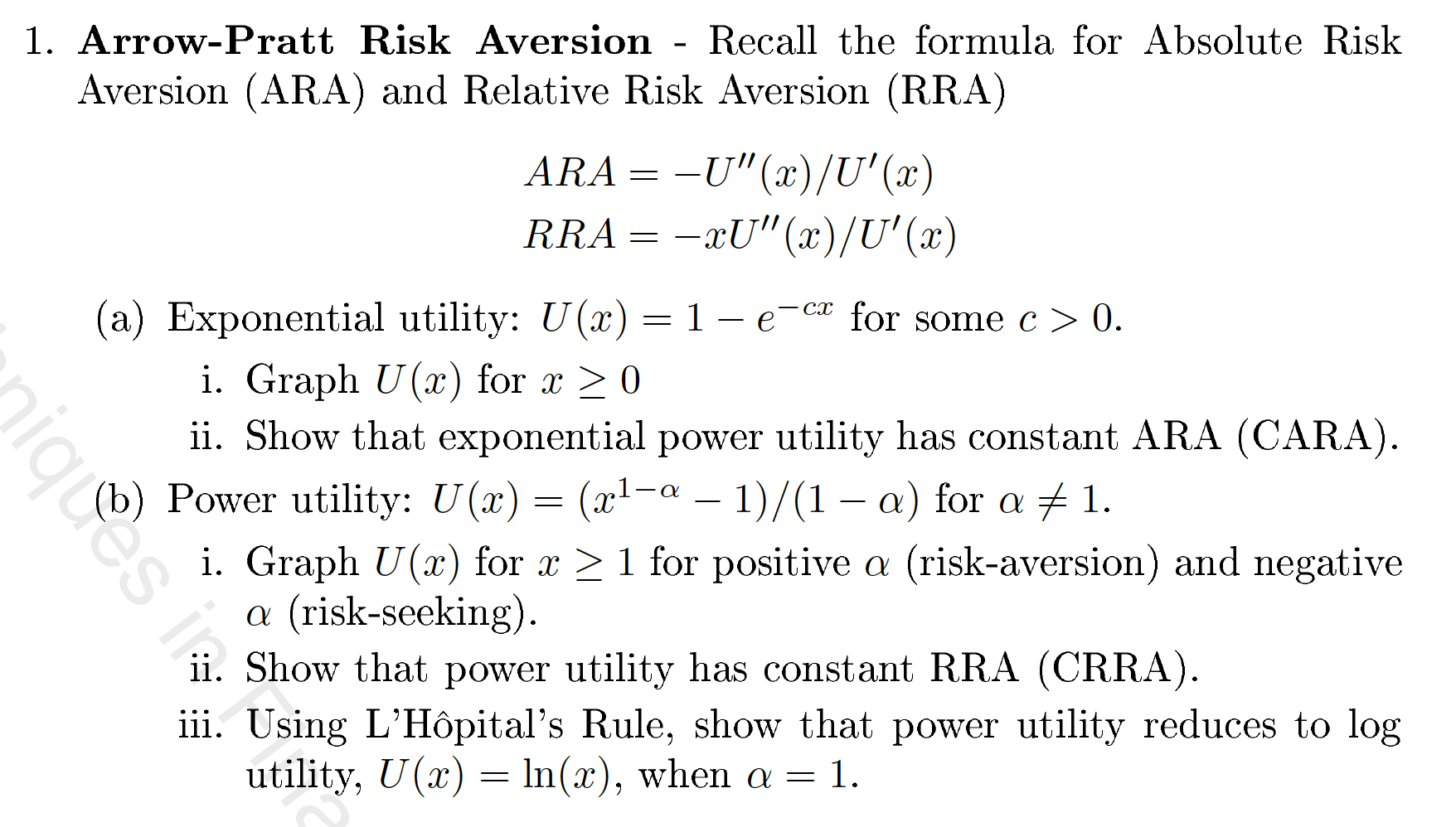

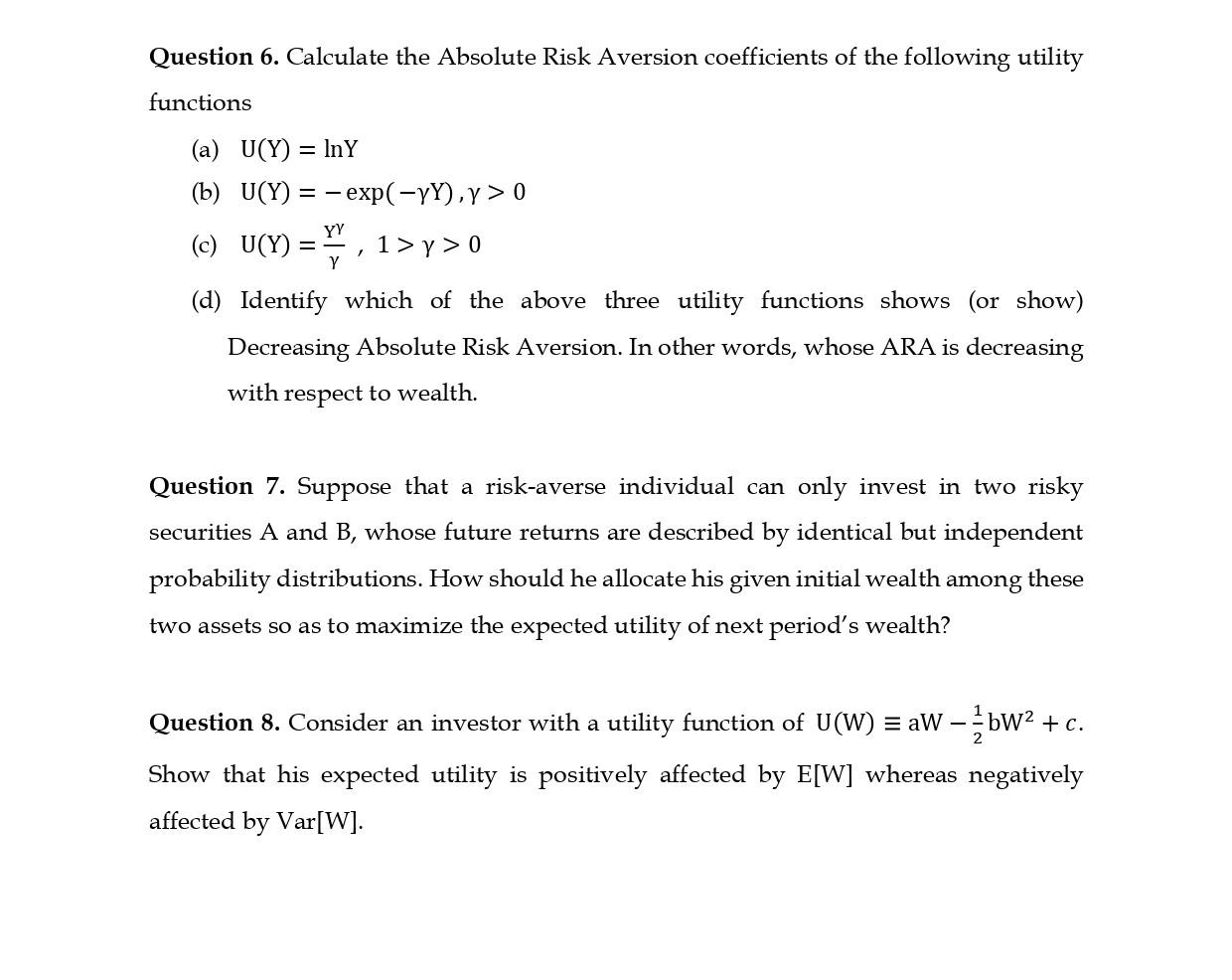

Financial Products and Markets Lecture 5. Investment choices and expected utility The investment techniques are based on a system of rules that allows. - ppt download